kansas dmv sales tax calculator

Do you live in Kansas and need to file for divorce. To calculate salesuse tax for your vehicle use the tax rate lookup tool on the Washington Department of Revenue website.

Have I Overpaid My SalesUseEmployer Withholding Tax Account.

. Depending on the county agent you may also be asked to provide. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Weekends 7 am-4 pm.

Car Tax by State DMV Fees Bank Payoffs My Vehicle Title Get My Lost Title Bill of Sale Sales Report FI Menu Loan Calculator. Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. Kansas does charge tax on trade-ins but not on rebates so you would subtract 2000 from the car cost to get 43000 which is the taxable amount.

Our network attorneys have an average customer rating of 48 out of 5 stars. Kansas residents serving full-time in the military are eligible for a motor vehicle property tax exemption. Sales Report FI Menu Loan Calculator Insurance Companies Roadside Assistance.

Find out about the residency requirements and procedures. Get the right guidance with an attorney by your side. Additions to Tax and Interest Calculator.

To apply submit an Affidavit for Motor Vehicle Tax Exemption Form TR-60 to your county treasurer. Lienholder for Pennsylvania Kansas 10909 McCormick Rd. Iowa Documentation Fees.

Kansas Documentation Fees. Online License No Tax Due System. Motor Fuel Licensee List.

Average DMV fees in Kansas on a new-car purchase add up to 39 1 which includes the title registration and plate fees shown above. Most states charge sales tax on vehicles. 39-49depends on county NA.

File SalesUse or Withholding Tax Online. The basic DMV fees like the title license plate and registration fees are no biggie. Below we list the state tax rate although your city or county government may add its own sales tax as well.

You do NOT have to pay the use tax if. These fees are separate from. Mon-Fri 5 am-7 pm.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. In-State Kansas Military Members. Missouri Department of Revenue Home Page containing links to motor vehicle and driver licensing services and taxation and collection services for the state of Missouri.

The previous owner had the vehicle for at least 7 years and is from a state. Bond Refund or Release Request. You can prove that the previous owner paid sales tax on the vehicle.

In this example multiply 43000 by 06 to get 2580 which makes the total purchase price 40580 account for trade-in. The vehicle was gifted to you and. These fees are separate from.

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Car Sales Tax Calculator Missouri Country Club Plaza Photography Courses

Trade In Sales Tax Savings Calculator Find The Best Car Price

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Capital Gains Tax Calculator 2022 Casaplorer

6 Mileage Form Templates Word Excel Templates Mileage Tracker Printable Mileage Log Printable Mileage

/RevenueV2-164285fdfca2439ca653153fade50d47.png)

What Is Revenue Definition Formula Calculation And Example

Income Tax Calculator 2021 2022 Estimate Return Refund

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

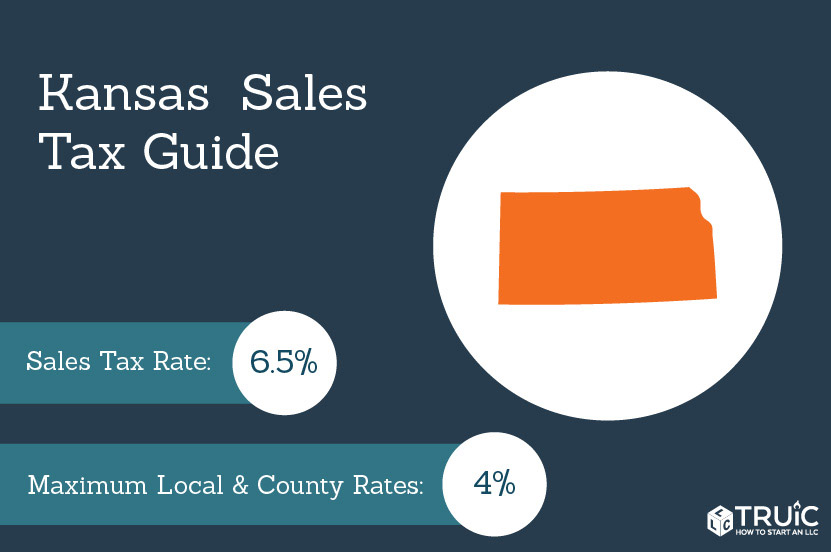

Kansas Sales Tax Small Business Guide Truic